1099 Contractor Invoice Template

Reasonable late fees go up to 25 per year on unpaid sums. If you are not sure whether the individual is an employee or an independent contractor the IRS US.

Independent Contractor 1099 Invoice Templates Pdf Word Excel

The absence of any promise to pay for profit sharing pension paid holidays paid vacations insurance unemployment compensation or any other employment benefits.

. Talk with a Software Expert 800 827-1151. Form 1099-K merchant card and third party network transactions Form 1098 home mortgage interest 1098-E student loan interest 1098-T tuition Form 1099-C canceled debt Form 1099-A acquisition or abandonment of secured property Use Form W-9 only if you are a US. Our checkstub maker can generate a variety of professional and realistic paystub samples.

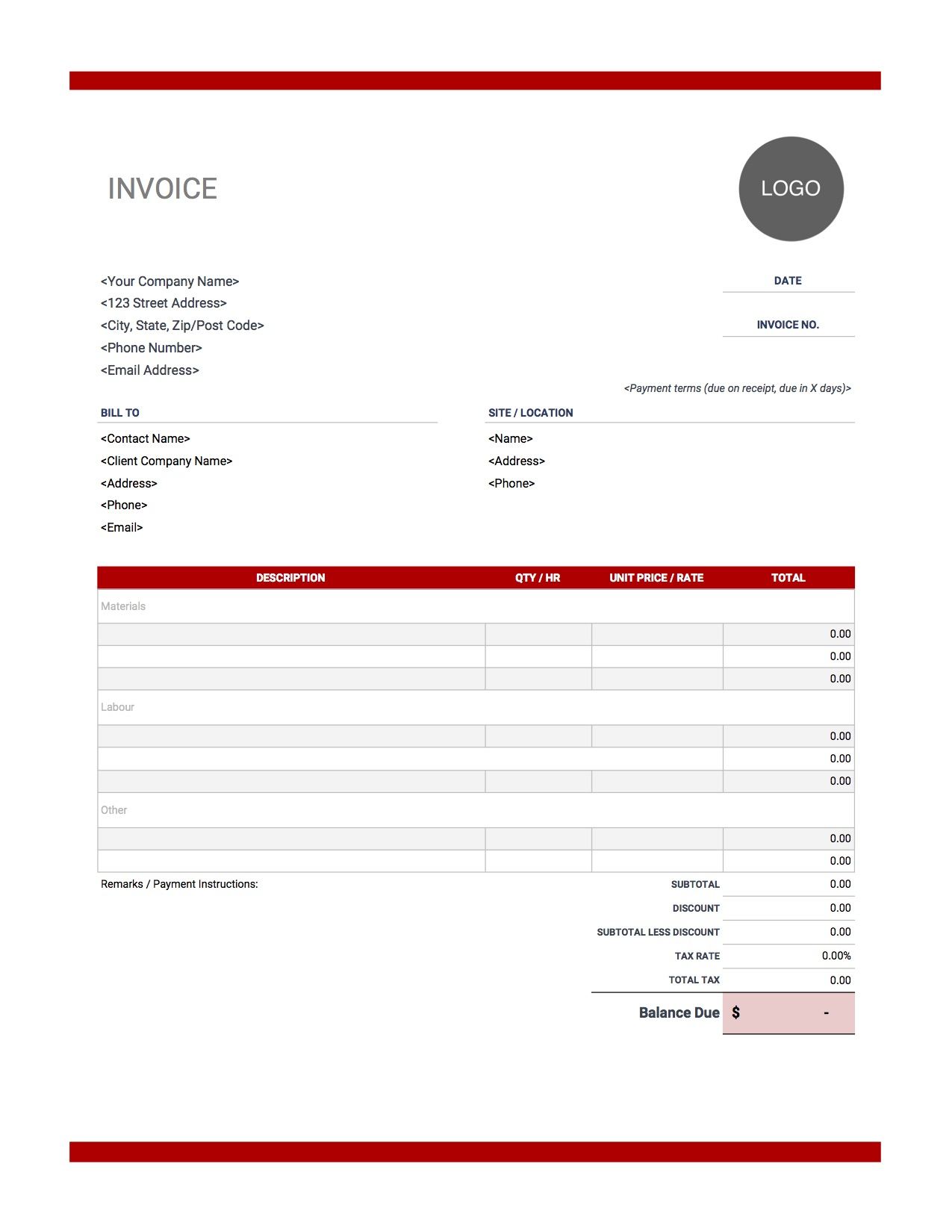

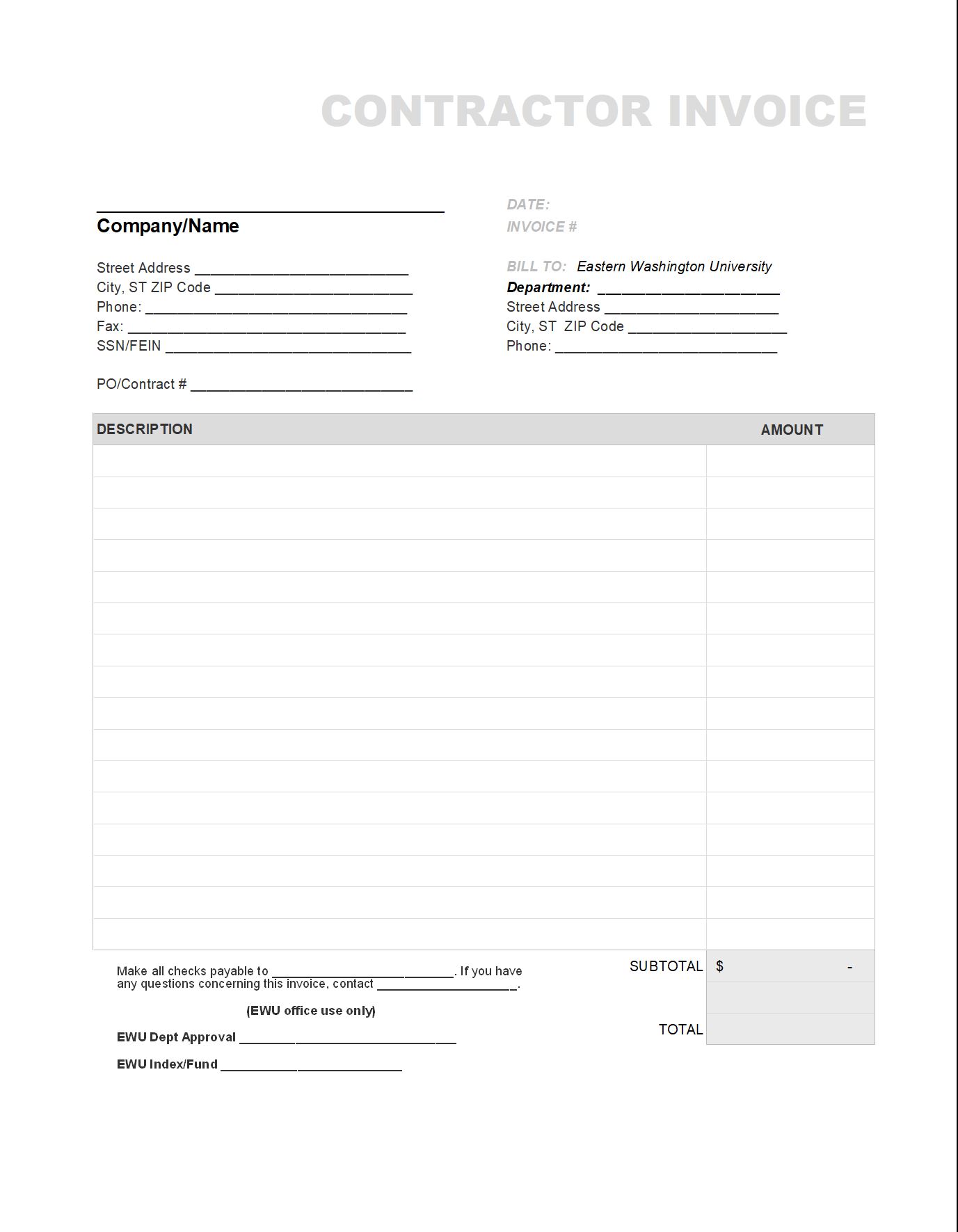

Free printable invoice template in multiple formats Use the free invoice generator to create customized invoices as many times as youd like. While similar information is included in sales receipts and invoices they are not the same. Fill out a W-9 in minutes using a step-by-step template.

Cost plus contracts are used when the scope of work is not clearly defined. Sign fax and printable from PC iPad tablet or mobile with pdfFiller Instantly. Sage 100 Contractor is an integrated business management and accounting system for general and.

A W-9 is a tax document issued to independent contractors and freelancers. Demo Pricing Write a Review About Sage 100. The Internal Revenue Service considers freelancers to be self-employed so if you earn income as a freelancer you must file your taxes as a business owner.

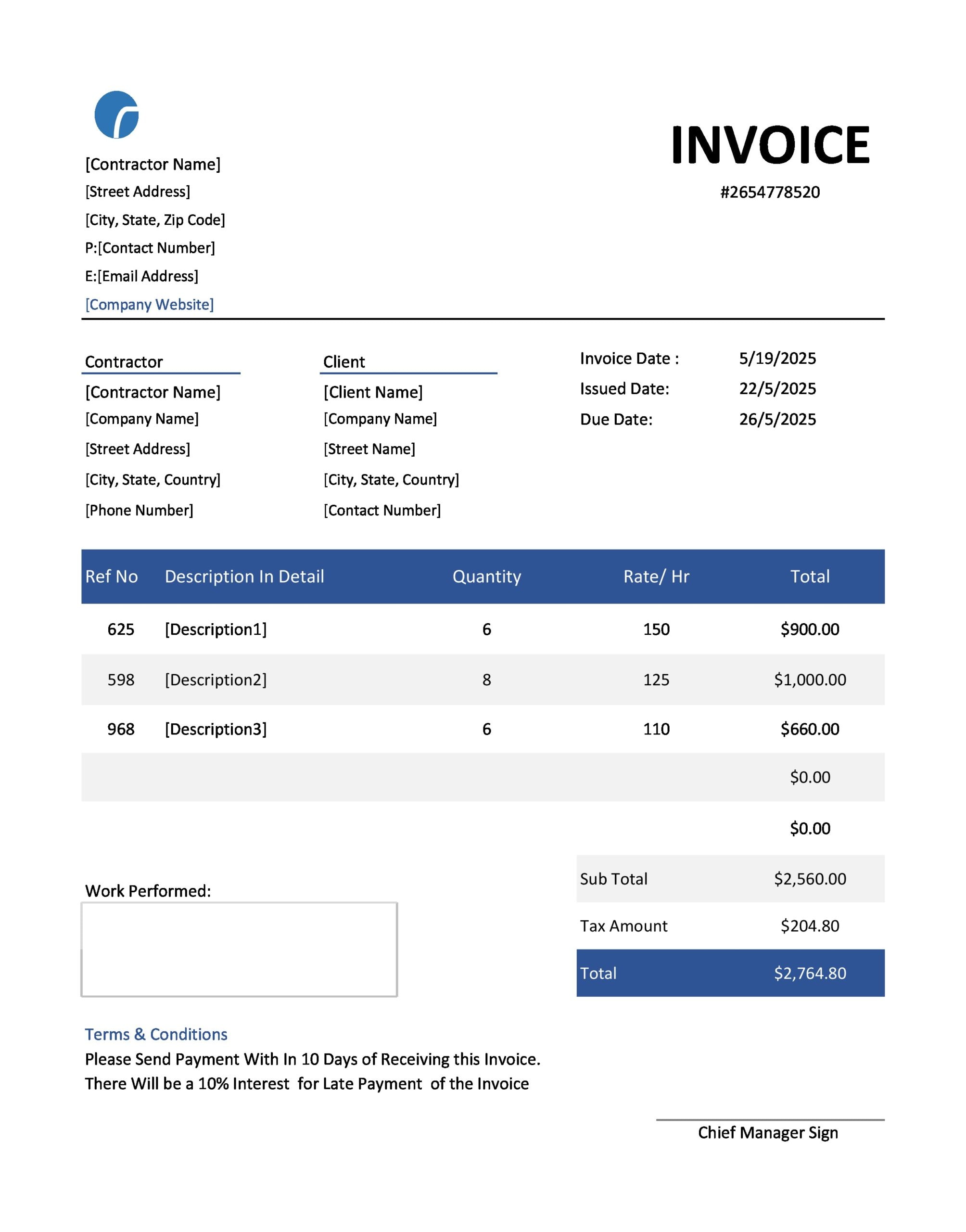

To find out what your tax obligations are visit the Self-Employed Individuals Tax Center. Remember that as an. The AIA contractor form G702 Application and Certificate for Payment is the form that the contractor uses to invoice on the project when AIA forms are required.

Paid after an invoice is issued. Thousands of US-based businesses use our tool to provide proof of income and. Employer and Employee.

You are not an independent contractor if you perform services that can be controlled by an employer what will be done and how it will be done. Person including a resident alien to provide your correct TIN. 1099-MISC Form 1099-NEC Form W4 Form.

If youre looking for a good template contract for an independent contractor. Looking for the perfect solution to run your freelance business. While you can take additional deductions if you are self-employed youll also face additional taxes in the form of.

Be sure to preview your invoice one final time to make sure everything looks good. An accountant will break down exactly how to fill out our 1099 template and give you tips as well as recommendations. W-9s are not used by individuals involved in an employer.

Does not file any unemployment insurance. Department of Labor your State Compensation Board your State Workers Compensation Insurance Agency and your State Department of Labor provide guidelines on how to make the callIf after reviewing the information you are still not sure. The AIA Document G7021992 is both the contractors request for payment as well as the architects certification determining whether or not you get paid.

Medical Power of Attorney. Durable Financial Power of Attorney Gives a caregiver the power to pay bills making deposits and providing the assistance needed to handle financial responsibilities on someone elses behalf. The owner will then pay the contractor an additional agreed upon fee which is usually either a flat fee or a fixed percentage that is based on a percentage of the total costs.

Customize your invoice template. The free construction estimate template or construction contract template has many static text labels on it which you must replace with your own text before you can create your first construction proposal contract or estimate. The contractor needs the 1099-NEC so that they may complete their taxes.

Some states dont allow interest rates above a specific. Is an invoice a receipt. As always the contractor proposal template also has a Invoice Manager for Excel version which you can download for free from the download page too.

Then download your PDF invoice and send it to your client. Self-employment tax payments being the responsibility of the subcontractor. You dont need to do anything to your copy of 1099-MISC but if you dont receive one you should follow up with your client.

The earnings of a person who is working as an independent contractor are subject to self-employment tax. 1099-MISC is an information filing form used to report non-salary income to the IRS. Set a deadline so the client knows how much time they have to pay the contractor after receiving an invoice.

The typical time frame for payment is 15 to 30 days. An invoice is issued to collect payments from customers and a sales receipt documents proof of payment that a customer has made to a seller. Sage 100 Contractor 17 Reviews 275.

Submit one copy of the 1099-NEC to the IRS and one copy to the contractor. It becomes the owners responsibility to establish some limits on how much a contractor bills. The contractors required provision of a 1099 form at years end for the subcontractors tax filing purposes.

Fill Estimate Template Edit online. If you are looking for a 1099 excel template with step-by-step instructions read this article. Theyre required to file Form 1099-MISC and send you a copy of it.

100000 freelancers have trusted Bonsai for their contracts invoices and payments. Receipts are used as documentation to confirm that a customer has received the goods or services they paid for. If you do not return Form W-9 to.

The contractor can then apply an interest rate to any late payments. Freelancing certainly has its benefits but it can result in a few complications come tax time. Files IRS Form 1099.

Track expenses maximize tax write-offs and. Seeking paystub template samples for proof of income purposes. A full accounting software system designed by Sage for startups and small organizations.

Look professional win more clients and manage your business from one place.

Independent Contractor 1099 Invoice Template

Contractor Invoice Templates Free Download Invoice Simple

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Free Freelance Independent Contractor Invoice Template Pdf Word Eforms

28 Independent Contractor Invoice Templates Free

Independent Contractor 1099 Invoice Template

Independent Contractor Billing Template Elegant 10 Contractor Invoice Samples Pdf Word Excel Invoice Template Invoice Template Word Invoice Example

28 Independent Contractor Invoice Templates Free

Independent Contractor 1099 Invoice Templates Pdf Word Excel