Interest Rate Calculator Uk, Rd Calculator By Temenos Uk Ltd

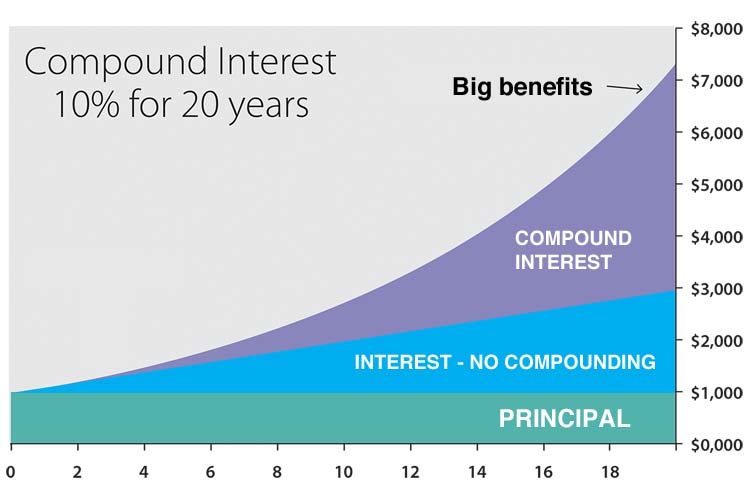

No matter how much or how little saving is a great habit to get in to. Compound interest is calculated using the compound interest formula.

Can An Nhs Consultant Surgeon Pay Off A Student Loan Student Loan Repayment Calculator 2021

The effective interest rate is equal to 1 plus the nominal interest rate in percent divided by the number of compounding persiods per year n to the power of n.

Interest rate calculator uk. At this point the calculator will use the long-term rate of the next year and repeat the process. The interest calculator helps illustrate how much money will be made with the power of compound interest. AER Annual Equivalent Rate shows what the interest rateexpected profit rate would be if it was paid and compounded once each year.

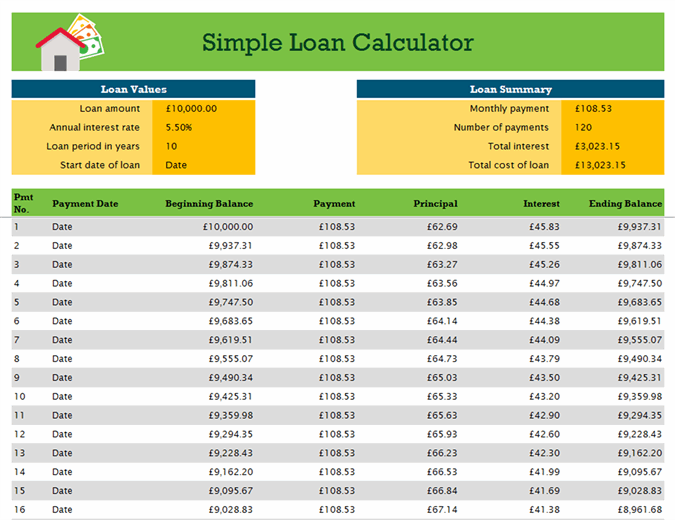

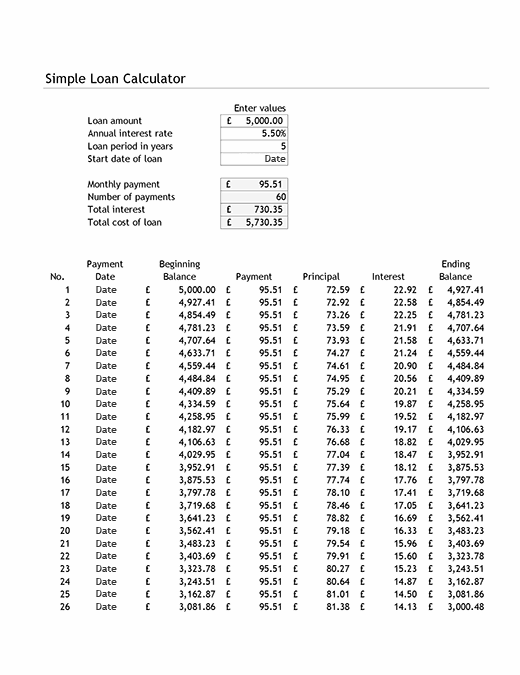

The principal plus the interest accumulated is reinvested at that same rate for the second year and continues at that rate for the number of years of the term you have selected. We dont charge you any fees for our services. 55 APR Representative based on a loan of 10000 repayable over 60 months at an interest rate of 55 pa fixed.

This is a compound interest calculator savers can use to get an idea of how returns and compound interest can work in their favour over the long term. It is made particularly useful with the top up box to simulate regular savings over a period of time. Use our savings calculator to see how much interest you can earn from your savings account.

Monthly repayment of 19039. Subtract the initial balance if you want. Simply key in the amount of savings you have your current interest rate and choose the tax status of your account and well calculate how much interest youll earn on that amount.

Using our savings interest calculator will give you an idea of what interest you will receive after tax each month or year and help you make the most of your money. A loan repayment is calculated by multiplying the loan by the interest rate. Adjust the lump sum payment regular contribution figures term and annual interest rate.

You can use our guides loan comparisons and interest repayment calculator free of charge. The formula to calculate simple interest is. Interest rates are shown as a percentage of the amount you borrow or save over a year.

Effective Period Rate Nominal Annual Rate n. Interest is what you pay for borrowing money and what banks pay you for saving money with them. It helps you compare the rates on.

100 10 year 1 10 year 2 120. Effective period interest rate calculation. Calculate the simple interest for the loan or principal amount of Rs.

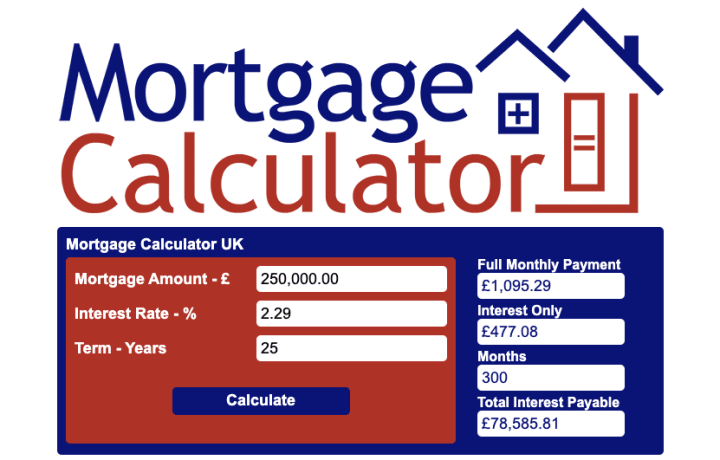

Lenders offer their loans at an interest rate that is either fixed for the duration of the loan or subject to fluctuations either up or down usually linked tobthe interest rate set by the Bank of England. Basic mortgage calculator. Compare several options to find the cheapest.

Even a small change can have a big impact. Use our interest rate calculator to work out the interest rate youre receiving on credit cards loans mortgages or savings. What are interest rates.

This approach is to calculate the annual amount of interest on the principal sum then divide by 365 to obtain a daily amount of interest and then multiply this daily amount by the actual number of days in the relevant period. The Gatehouse Chambers online calculators are provided for you to use free of charge and on an AS IS basis without any technical support or warranty of any kind from Gatehouse Chambers including without limitation a warranty of merchantability fitness for a particular purpose and non-infringement. Choose how much you want to save or borrow.

Whether you have started saving yet or not this calculator will let you see how long it will take you to reach your goal whether thats to save enough for a new car house. So if you put 100 into a savings account with a. He would simply be charged the interest rate twice once at the end of each year.

You can use the calculator below to calculate interest payments. Enter your initial deposit and any recurring top-ups you may make to your savings. This is a great tool to observe and measure the effects of your potential saving and investment decisions.

You can use the monthly repayment calculator to compare real-life examples. How to use our calculator. Put the interest rates loan terms and amounts of the loans in our comparison into the loan interest rate calculator.

Simply enter the APR and start your calculation today. All you have to do is add the amount you plan to invest in the first box the annual interest rate in the next box and finally the length of time this interest rate will apply for in the bottom box. Interest principal interest rate term.

Derek owes the bank 120 two years later 100 for the principal and 20 as interest. This translates as a cost of borrowing. You can then select the number of years you wish to save for the compounding interval and even compare 2 different interest rates at once.

Also learn more about interest cost experiment with other interest and loan calculators or explore many more calculators on topics such as finance math fitness and health. The effective period interest rate is equal to the nominal annual interest rate divided by the number of periods per year n. Use the compound interest calculator to see the effects of compounding and interest rates on a savings plan.

The APR interest rate youll be charged depends on your personal circumstances and will usually be between 28 and 999. This will show you how the interest rate affects your borrowing or saving. Check out the wonders of compound interest with the calculator below.

Shows the cost per month and the total cost over the life of the mortgage including fees interest. Effective annual interest rate calculation. P 5000 R 10 and T 5 Years Applying the values in the formula you will get the simple interest as 2500 by multiplying the loan amount payment with the interest rate and the time period.

Our free loan calculator helps you assess the monthly and total cost of any loan. An interest rate is a percentage that is charged by a lender to a borrower for an amount of money. To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods.

Free calculator to find the interest rate as well as the total interest cost of an amortized loan with fixed monthly payback amount. The interest is calculated as simple interest using the conventional approach used by litigation lawyers in England and Wales. Enter the amount into the box.

The compound interest calculator starts by multiplying the Amount A by the Interest Rate IR to calculate the Interest Amount IA due after the first. 5000 with the interest rate of 10 per annum and the time period of 5 years. Our lump sum investment calculator is very easy to use.

Use the slider to set the interest rate.

Interest Rate Calculator Amazon Co Uk Apps Games

Compound Interest Calculator Daily Monthly Yearly Compounding

Compound Interest Calculator Daily Monthly Yearly Compounding

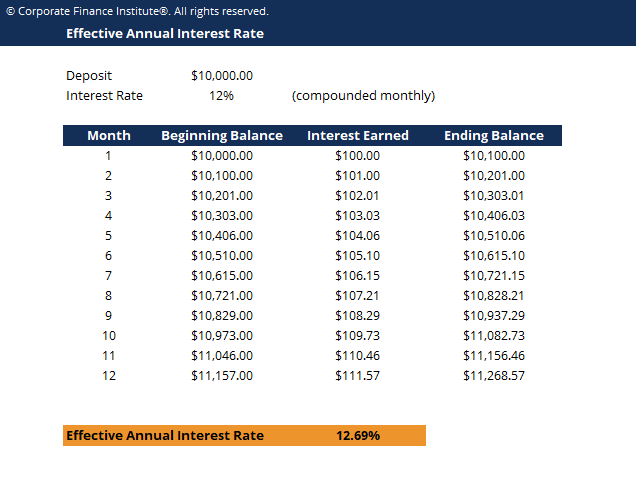

Effective Annual Interest Rate Calculator Download Free Excel Template

Rd Calculator By Temenos Uk Ltd

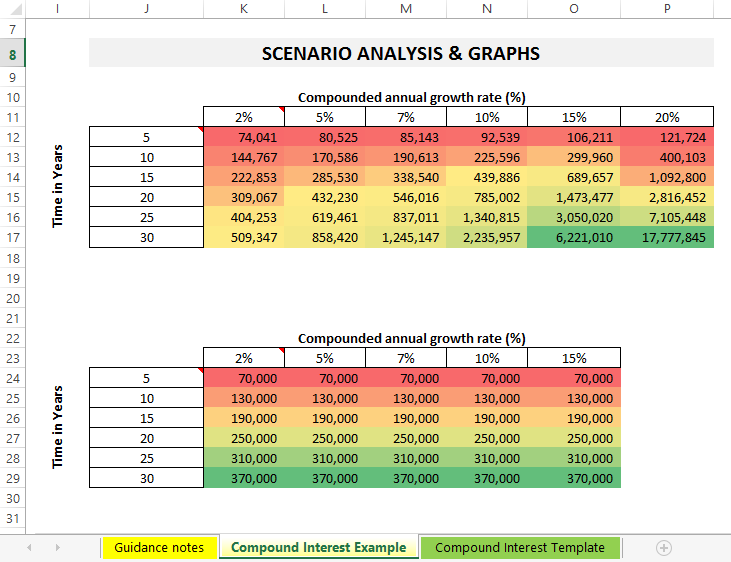

Compound Interest Calculator For Excel

Mortgage Calculator How Much Can I Borrow Comparethemarket Com

Interest Rate Calculator Uk Online Discount Shop For Electronics Apparel Toys Books Games Computers Shoes Jewelry Watches Baby Products Sports Outdoors Office Products Bed Bath Furniture Tools Hardware Automotive

Mortgage Repayment Calculator Graph

How To Calculate Loan Interest Bankrate

Mortgage Calculator Uk By Grimwood Android Apps Appagg

3 Ways To Calculate Daily Interest Wikihow

Annual Percentage Rate Wikipedia

Blog Student Loan Repayment Calculator 2021